The Nvidia Way: A Good Book, Yet Fairly Selective

At the end of 2024 a new book called The Nvidia Way by Tae Kim came out. Since I had a bit of a break for the holidays, I read it from start to finish. It’s a decent book, but there are quite a few flaws that I want to highlight, being very familiar with the same era as well. But let’s start by the good bits.

The good parts

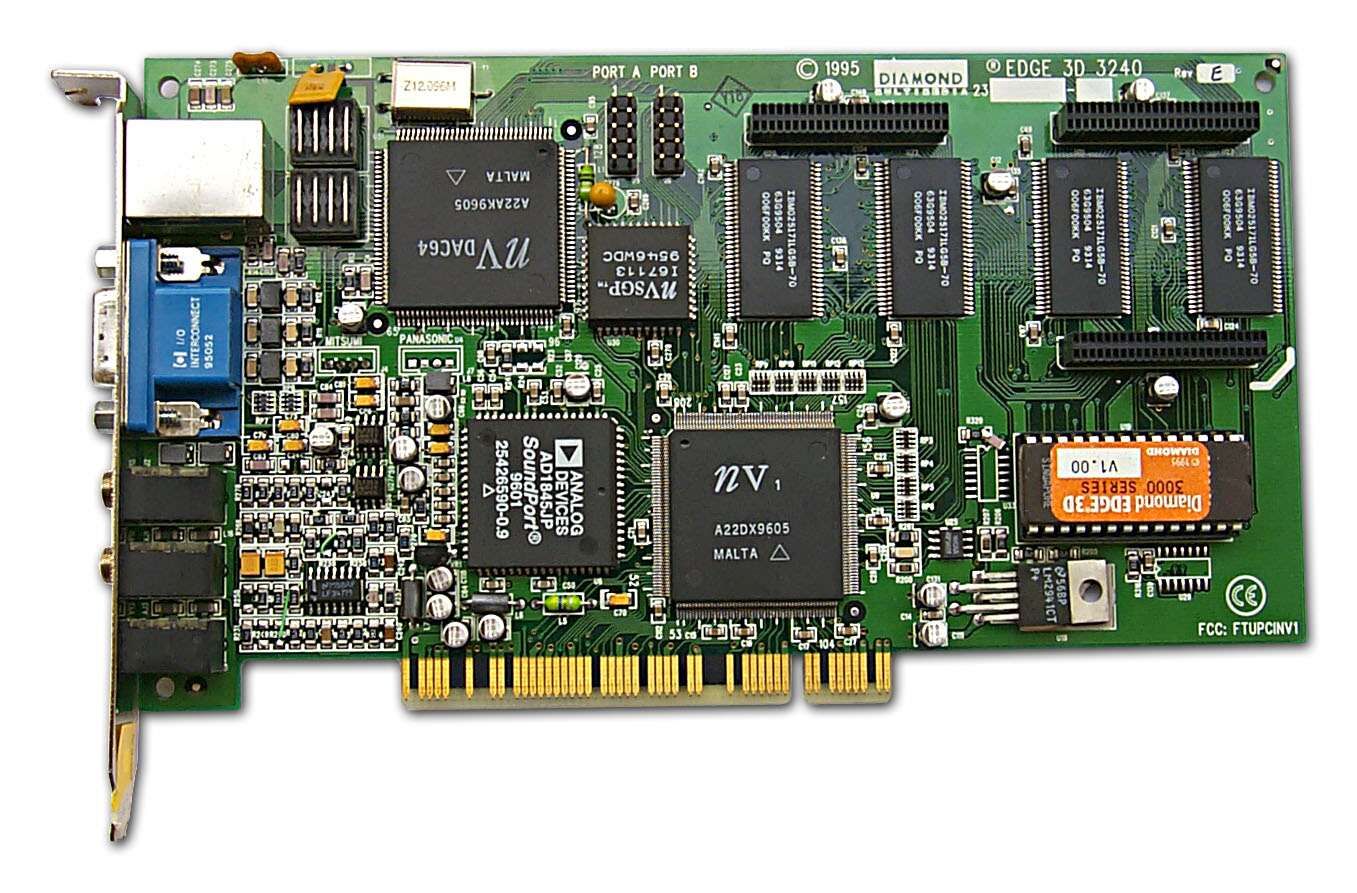

The book more or less goes through the chronological history of Nvidia, and the accounts of how the co-founders started as a small startup, struggled to get proper investment, and made a few mistakes that almost killed the company back in the 1990s. Their first chip, the NV1, had several issues and was not a market success.

Their second chip, the NV2, was supposed to be used for a new Sega console, but the deal fell through as Sega was in trouble at that time, so the NV2 did not make it to market. The NV3 was their chance to make or break, and it’s the chip that was later renamed as Riva and enjoyed widespread success with the Riva TNT series of cards.

The book explains the origins and the personalities of the co-founders, the technical background and expertise they had before starting Nvidia. This is a great read since this was an era of great innovation and I had always wondered what kind of people were ahead of the curve. At the time, the graphical capabilities of the PC were pretty poor, and you needed to have a 2D card to display 256 colors or more on screen with good resolution. The concept of having an additional card for 3D acceleration was completely new - nobody had done it yet.

It turns out that two of the co-founders came from Sun Microsystems and were part of a hardware team working on advanced workstation graphics capabilities. They had already developed some specific chips for such workstations to be able to render high level 3D graphics that could be used for simulations and professional applications.

It soon became apparent to them that there was a way to make such graphics processors cheaper to boost what could be delivered in the growing PC gaming market through the availability of rapid interfaces like VESA and PCI.

Jensen Huang, the third co-founder and the future CEO of Nvidia, worked for LSI and was an expert in designing logic boards. The three of them started to work together on the GX board for the Sun Microsystems hardware, and this is how they got to know each other’s and realize that they had a bunch of very complementary skills. Jensen was chosen to become the CEO as the two other co-founders were more interested in the technical aspects of the work than the business of driving the company and securing investments.

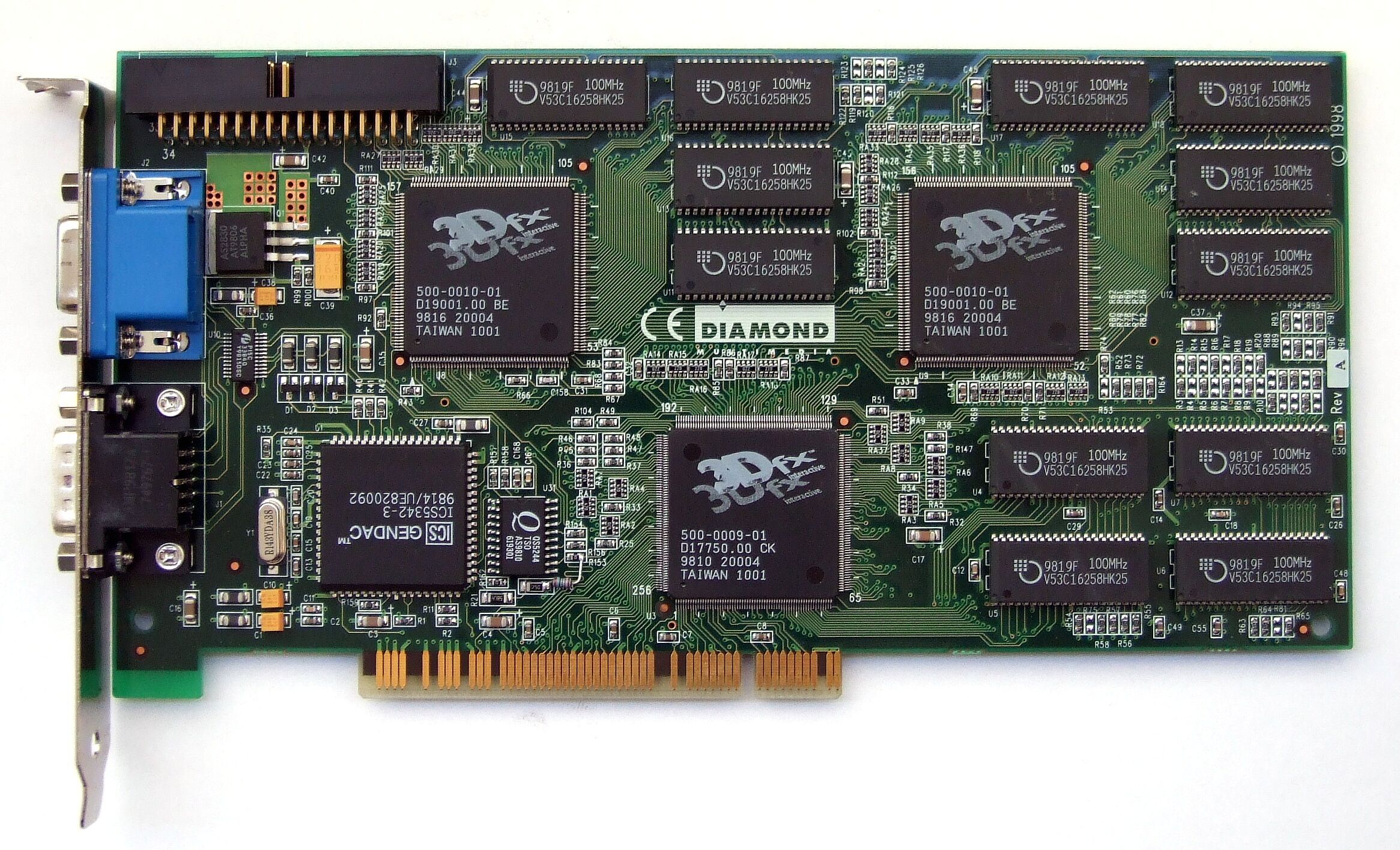

The competition was fierce at the time and the company 3dfx was the first mover in the 3d graphics card space with their revolutionary Voodoo 3D graphics card.

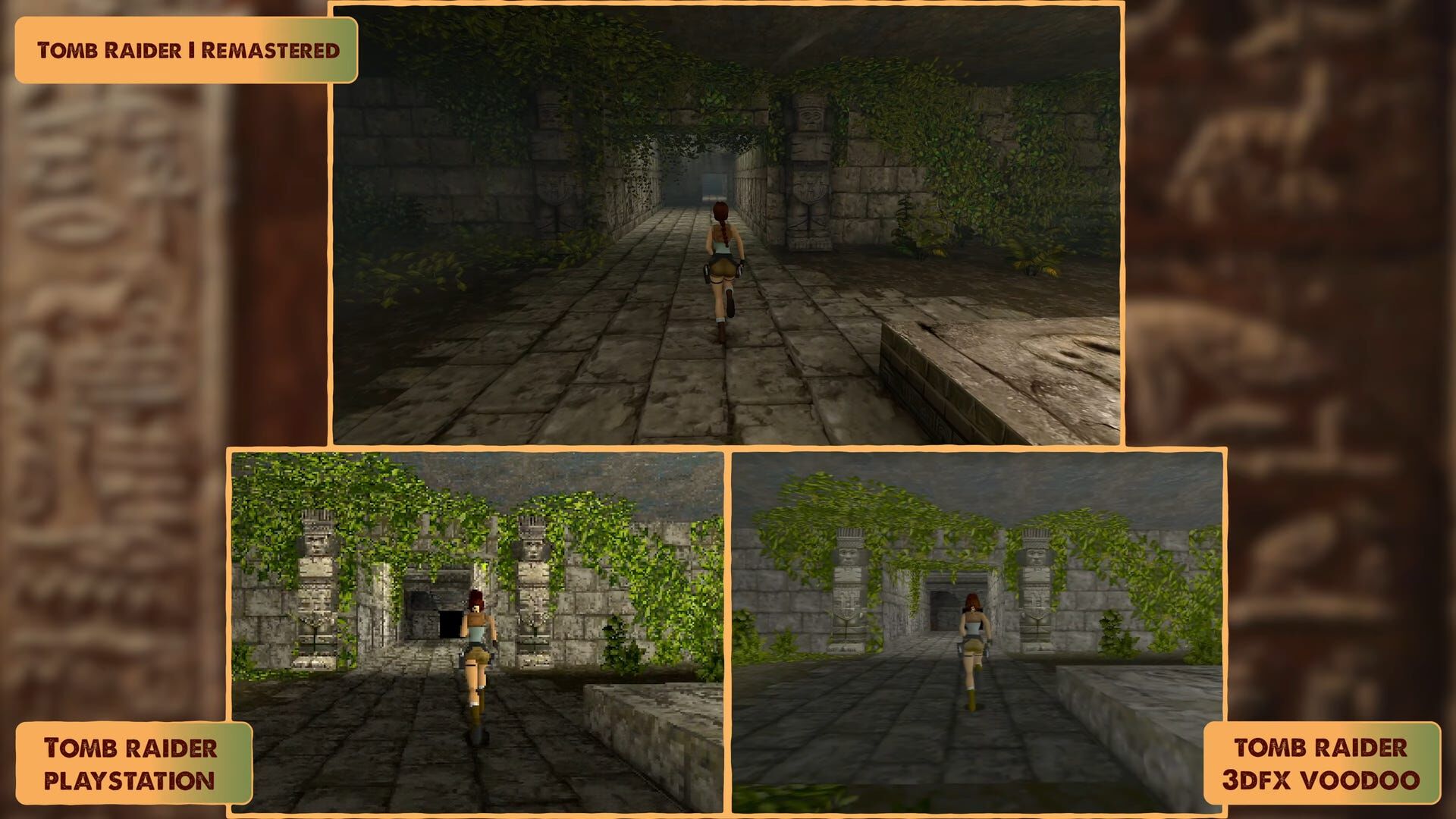

In the mid 90s, the Playstation was hailed as a revolution in 3D capabilities in the console world - and this much was true - however the 3dfx Voodoo graphics was much more powerful and you could see the huge different in performance on games such as the original Tomb Raider.

The PS1 had a much lower resolution, less memory for textures, and could not even handle the same kind of framerates. The 3D acceleration on PC was going to put PC Gaming front and center - and this was already clear at that time, even in the early days.

Since 3dfx was the first mover, it was not given at all that Nvidia would be able to overtake 3dfx (whose founders came from Silicon Graphics) but the combination of fast-pace iteration on Nvidia’s end and some key missteps on 3dfx’s end (the acquisition of a huge graphics boards manufacturer, STB, which turned out to be a disastrous move as they had no clue on how to manage such a business) paved their way to gain a very comfortable market share.

Funnily enough, in the early days 3dfx considered buying Nvidia when they were still small, and at the end of the day it was Nvidia who bought the remains of 3dfx when they bankrupted.

Nvidia also made some smart business moves by being the first company to work directly with developers to ensure that the highest profile games perform better ahead of release on Nvidia hardware. It’s the famous the way it’s meant to be played program.

The book covers what makes Nvidia different from other companies in terms of culture and processes. Jensen seems to have shaped the organization around him with a set of clear principles and systems:

- A relatively flat organization in its structure

- A culture of direct and tough feedback (Jensen does not mind tackling employees in front of everyone)

- Hardwork and long hours are the norm

- Direct oversight of what every employee is doing, through a email process (what are the 5 things you are working on?) to Jensen

- Focus on making teams work well together and aligned on the same objectives (following big issues in their early years)

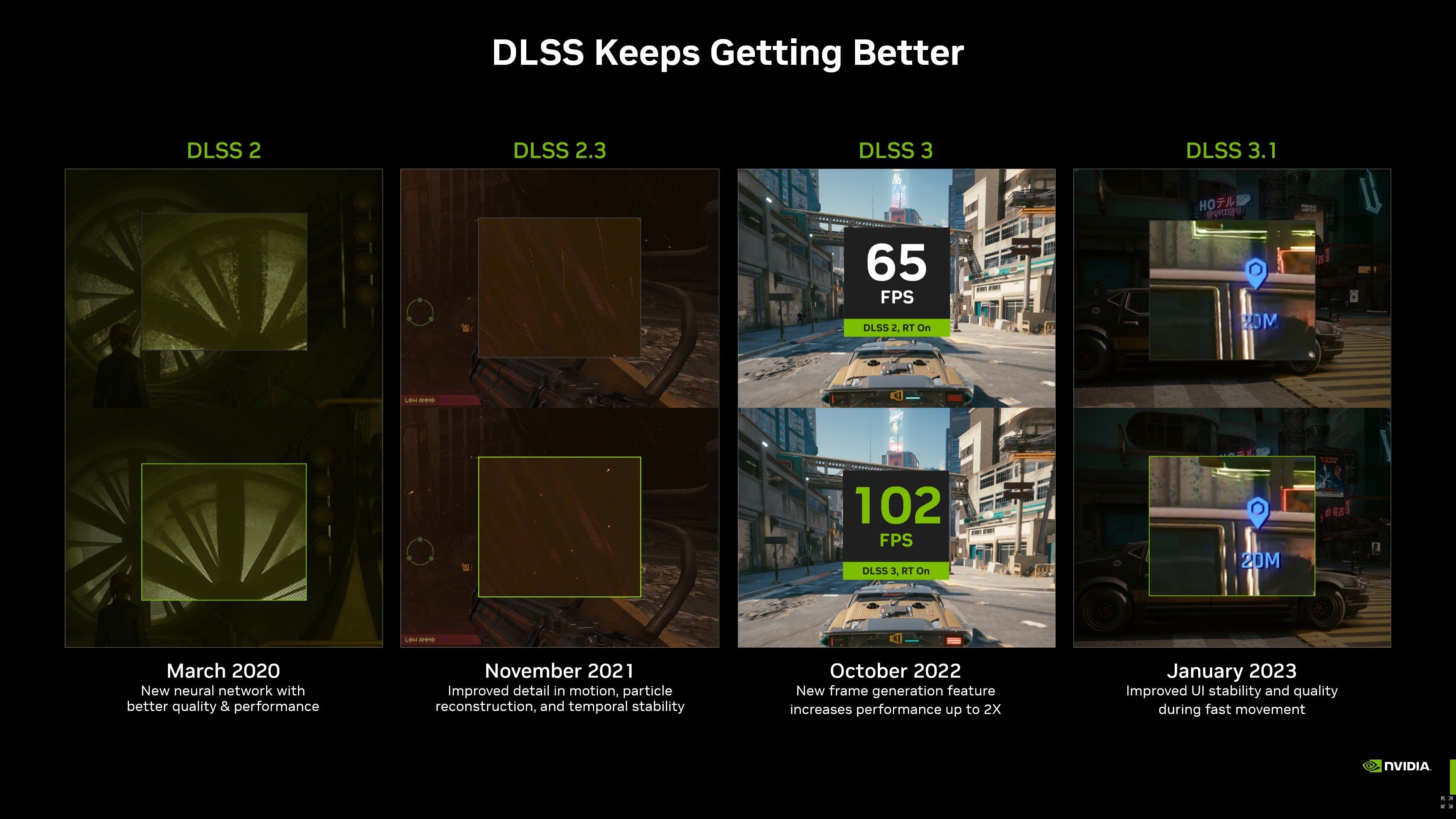

- Investing in long term bets (which gave rise to programmable shaders, CUDA, DLSS and more initiatives). Jensen has been a great proponent of these investments even when challenged by the board.

- Speed to market: look for tools and techniques to reduce the time needed to iterate on new technology. In the early days, iterating on processors means that you had to wait to have a prototype board in hands, but Nvidia invested early on on machines that could simulate processors at the design stage, and enable optimization and software fixes way ahead of the manufacturing process.

Those are great insights about the inner workings of the company, and they are corroborated by several employees and ex-employees that Tae Kim has interviewed for the book.

The bad: Huge blanks and bias

The issue with these kinds of books is always the same. You had dozens of competitors out there at the time, and nowadays you end up with a market mostly centered around AMD and NVidia (with Intel trying to make itself a seat at the table again), and whatever Nvidia did will be ultimately seen as the elements that made them survive. To really understand if these elements were the right ones, the essay would have to focus on what competitors did and did not do, what were their strengths and weaknesses, and what decisions they made that ultimately sent them on a wrong path (and why they made those decisions).

Absent competitors?

Since the book focuses mostly on Nvidia, you completely lack that aspect of things and you end up with statements that may or may not be ultimately correct regarding the reasons why Nvidia made it and others did not.

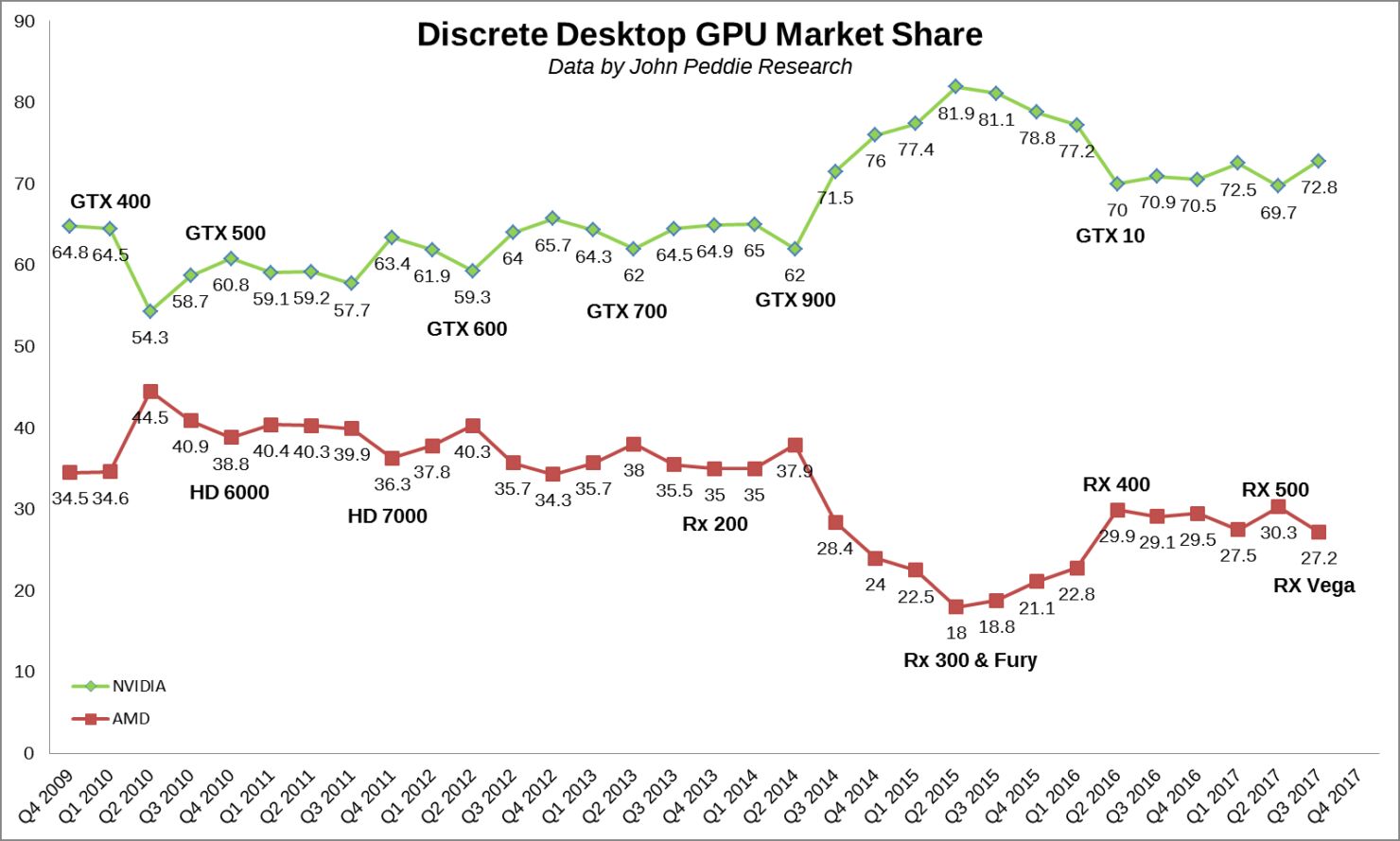

You get a glimpse of that with the stories related to 3dfx, but there is nowhere enough of such analysis for the most recent times since the 2000s. ATI and then AMD were a very strong contender against Nvidia and they hardly receive much mention in the book. The dominance of Nvidia is a much more recent phenomenon than the book suggests, with ATI and AMD being relatively head to head versus Nvidia for a fairly long time. In the past 10 years or so, Nvidia’s long term bets on CUDA have made them a clear winner in the enterprise space, while the ray tracing investments have hardly had much impact (Ray tracing is not a significant driver for most gamers to forsake AMD, and there are a lot of accounts of gamers on Nvidia turning off the feature in the games that support it).

Tae Kim goes over the implementation of DLSS as a competitive advantage, but completely misses the part that AMD also introduced a very competitive solution with FSR that did not rely initially on training models for each game.

FSR also works across all architectures, while Nvidia adopts an inferior approach with DLSS by restricting newer versions to newer cards just to ensure they maximize the sales of their new models.

Crypto-blank

There are more blanks, such as the complete lack of any mention of the crypto market boom, which was a huge driver for GPU demand for years in the late 2010s. For years, gamers could not buy GPUs at an affordable price because the demand was driven by crypto-miners. The fact that this is just not there is bewildering. This is one of the reasons why CUDA took off in the first place, well before AI came over as a market driver. Nvidia paid fines in 2023 to the SEC for failing to reporting the impact of crypto-mining in its gaming revenues back in 2018. I quote:

In two of Nvidia’s Form 10-Qs for fiscal 2018, Nvidia reported material growth in revenue within its gaming business, said the SEC in a press release. However, continued the agency, Nvidia was aware – but failed to disclose to investors – that the boost in sales was, in significant part, driven by crypto mining.

“NVIDIA’s omissions of material information about the growth of its gaming business were misleading given that NVIDIA did make statements about how other parts of the company’s business were driven by demand for crypto, creating the impression that the company’s gaming business was not significantly affected by crypto mining,” said the SEC.

Another article on the matter revealed that Nvidia allegedly actively tracked the performance of crypto-mining related sales, up to the CEO, Jensen.

The lawsuit hinges on claims that Nvidia concealed the full extent of its exposure to the cryptocurrency sector by downplaying how crypto miners were driving a large portion of GPU sales. DeCrypt also notes that Nvidia allegedly maintained a global database to track GeForce GPU sales to crypto miners, with this information coming to light through firsthand accounts from former Nvidia employees. One insider, dubbed “FE 1,” described how this database was used to track sales to miners, while another insider, “FE 2,” detailed how Nvidia’s CEO, Jensen Huang, was directly involved in sales meetings where the impact of cryptocurrency on revenues was discussed. These insider accounts, combined with internal documents and a notable drop in Nvidia’s revenue following the 2018 crypto crash, form the basis of the evidence supporting the claim.

Tae Kim rewrites history by making it sound like CUDA took off just because of a bunch of data scientists who wanted to train models, but this is just not true. CUDA was a technology that failed to initially take off. The crypto market clearly came first and vindicated the Nvidia approach before anyone ever thought of transformers.

The legendary Nvidia Software Support!

There’s also no mention of the bad parts of Nvidia’s software stack, such as the poor support of the Nvidia chips on Linux x86 platforms. Once again this feels like a fairy tale version of Nvidia’s story rather than a truthful one. Why fail to mention the Nvidia Fuck You story from Linus at all? After all this was a significant stain on Nvidia’s brand, and for good reasons.

It would not have to be a negative story in the end, as Nvidia actually ended up improving their official Linux x86 support several years after this happening. And this is a story that matters, because better Linux support means that the Nvidia GPUs are easier to integrate in data center workflows, which is now the main business of Nvidia in 2025.

You won’t hear much about the Nvidia Shield either. The Nvidia Shield was a series of stand-alone devices (console and portable format) that Nvidia tried to develop that failed to find a market - it’s actually still being sold. This deserves an award for the ugliest piece of hardware ever made, too, but that’s a subjective point, I guess. Why omit this story? Because it goes against the narrative that Nvidia does everything right and Nvidia knows where the market is headed.

Still we are talking about Nvidia’s failures, let’s not forget that Nvidia sucks at giving software support to anything besides their GPUs. The Nvidia Shield is still sold nowadays, but there’s no Android upgrade path available, and the last security patch is from 2022… If you were wondering if that’s an exception, it’s not. The Jetson Nano developer SOC (think something similar to a Raspberry Pi, but equipped with CUDA cores for advanced ML and AI applications) suffers from the same problems.

It launched in 2019 with Ubuntu 18.04 support, and a few years down the road it’s already EOL with no support for upgrading the distribution to a more recent version. There are threads of hell on Nvidia developer forums that are well worth a read to understand how painful the whole situation is.

Even if you manage to somehow find an upgrade path, Nvidia is not providing new CUDA drivers for the machine, which means you are stuck with CUDA 10 or some earlier version while modern frameworks want CUDA 11 or even CUDA 12. A problem largely created by a culture of disposable devices at Nvidia. They want you to buy their next shit, not keep using what you have.

Tae Kim also talks about the Tegra in a fairly positive light, but to be fair Tegra was a failed SOC, market-wise. It was supposed to be everywhere in tablets and smartphones, and its choice was quickly supplanted by other competitors’ like Qualcomm’s chips because the Tegra had several issues including overheating.

It made it to the Nintendo Switch in the end, but that’s not what the original vision for the Tegra was. Let’s not retroactively change its positionning.

Jensen as Dear Leader

The book tends to put a lot of focus on the CEO, Jensen, as a kind of messianic leader. No doubt that Jensen is an extremely smart and hardworking person. You don’t stay a CEO for 30 years without being incredibly talented. But it seems reductive to put so much emphasis on him.

At some point, Nvidia has successfully built a moat, through a series of good investments, good decisions, and great partnerships (with TSMC). It would take a huge amount of disruption to make them derail. Just like Apple, Nvidia has secured a strong following and it would actually take a long series of mistakes to make Nvidia lose its footing - as their offering is very close to a monopoly at this stage - you can’t just replace CUDA easily. This means that you have to buy Nvidia for a number of applications. AMD and Intel may have competitive hardware, but they can’t replace CUDA and its integration in numerous software libraries.

Throwing Numbers

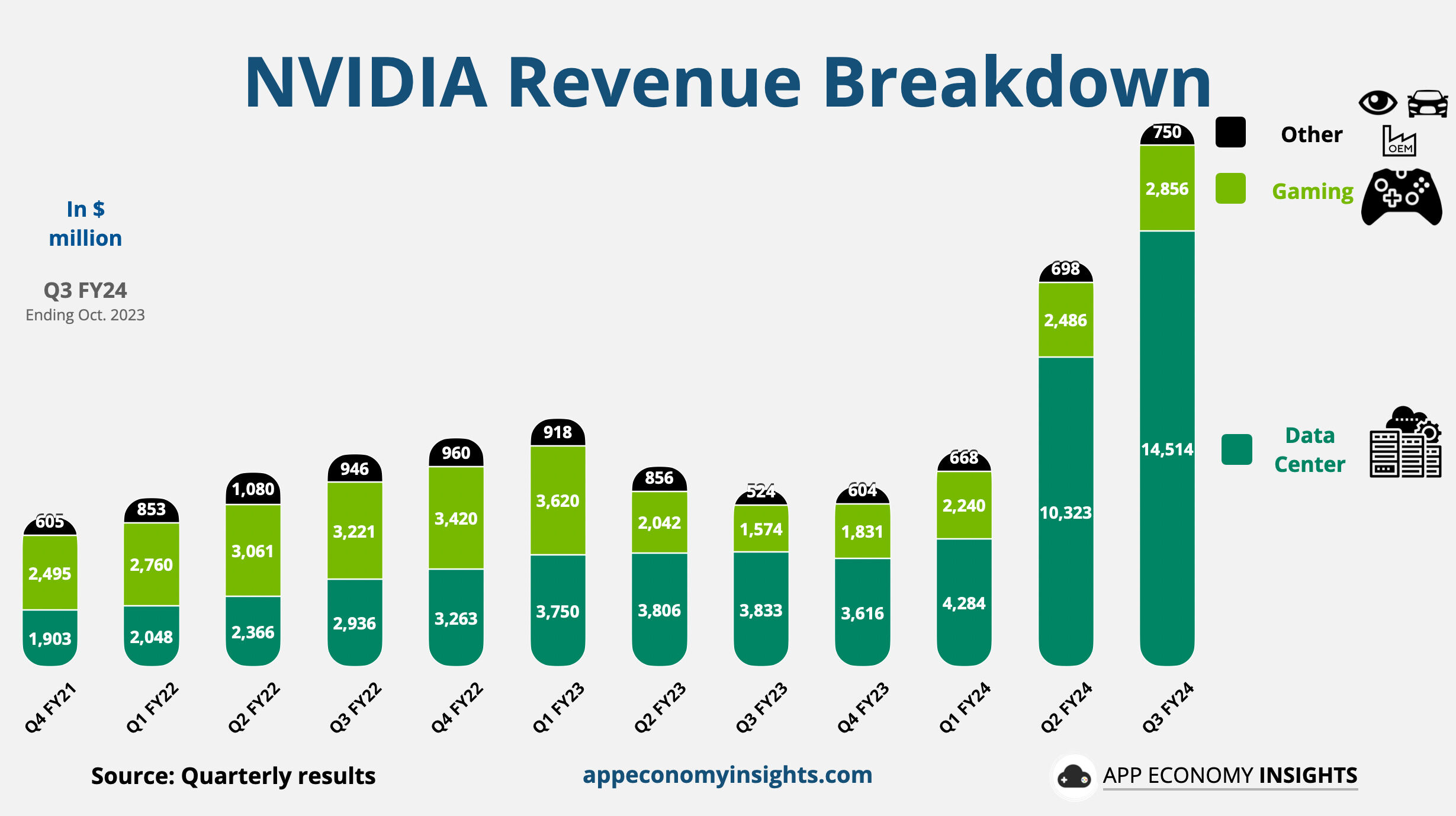

A final point, somewhat unrelated to the storyline, is the absolute lack of graphs. I can’t understand why someone can write a book in 2024 about business choices, industry trends and more and not include numerous graphs or charts along the way to explain what was actually happening using visuals. Throwing figures in the middle of paragraphs, without context, is just a very poor form of conveying quantitative information. Let me guess, it’s a bit more work than doing interviews?

Don’t Believe Everything You Read

This is a good reminder that because something is in a book, it does not make it true nor faithful to the reality. I think one of the main issues is that Tae Kim flew too close to the sun, and ended up writing a book based on a favorable access to Nvidia employees rather than a more balanced view on what makes Nvidia work and fail.

So, worth reading or not? It’s 50/50.

The first part about the beginnings of Nvidia is really worth it. It feels fairly accurate as well. You learn many things about what they did well and where they messed up.

The second part or the book about the later years of Nvidia is full of huge blanks (crypto black hole), positive spins and facts cherry picked to support a specific narrative. It’s nowhere near critical enough. It’s not a surprise for a company that invented the collaboration with 3rd parties ahead of big releases to ensure they get good glaring reviews - they know it works, and they probably did the same thing for the book.